ETH Price Prediction: Will Ethereum Shatter the $4,000 Barrier?

#ETH

- Technical Breakout: ETH trading 12% above 20MA with converging MACD

- Institutional Activity: Justin Sun's $226M move and BlackRock milestones

- Retail Participation: Robinhood bonuses and 288% volume surge

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge Near Key Resistance

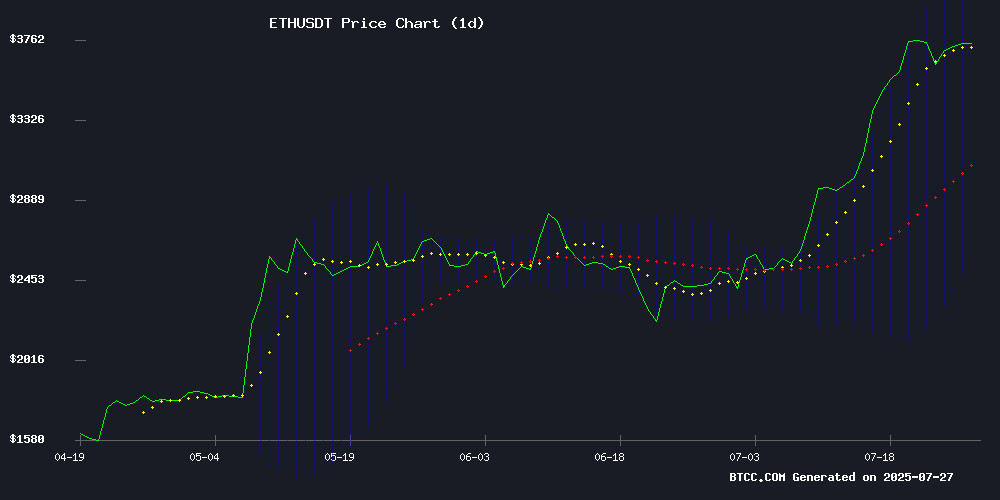

Ethereum (ETH) is currently trading at $3,769.12, showing strong momentum above its 20-day moving average ($3,359.16). The MACD histogram (-40.24) suggests weakening bearish momentum, while Bollinger Bands indicate potential volatility with prices testing the upper band ($4,125.35).says BTCC analyst Ava.

Market Sentiment: Ethereum Faces Make-or-Break Moment at $3,780

Justin Sun's $226M ETH repositioning and 288% on-chain volume surge highlight institutional interest, though futures overheating warnings persist.notes BTCC's Ava. BlackRock's milestone and Robinhood's 2% transfer bonus add retail fuel to the rally.

Factors Influencing ETH’s Price

Ethereum Faces Pivotal Moment as Accumulation and Leverage Clash Near $3,780

Ethereum's price action near the $3,780 level reveals a market at odds with itself. On-chain metrics signal strong accumulation—evidenced by 244K ETH exiting Coinbase and a $2 billion USDT mint by Tether Treasury—while derivatives data warns of impending volatility. The divergence between spot price and declining open interest on Binance suggests traders are unwinding leverage, a necessary cleanse before sustainable upside.

Funding rates have cooled to neutral, historically a precursor to healthier rallies. Ethereum's ability to hold above $3,600 despite these headwinds forms a textbook higher low pattern. Yet the path forward hinges on flushing out overleveraged positions, which could trigger one last shakeout before institutional capital deployment meets tightened supply.

Justin Sun Moves $226M in Ethereum from Lido to Aave

Justin Sun, founder of Tron, executed a significant ethereum transfer today, shifting 60,000 ETH (valued at approximately $226 million) from Lido to Aave. The transaction, originating from wallet (0x17…a132), occurred at 10:13 AM UTC+8.

Such large-scale movements between major DeFi platforms often signal strategic portfolio rebalancing or yield optimization. The transfer underscores Ethereum's continued dominance in high-value decentralized finance activity.

Futures Fuel Ethereum’s Rally to $3.5K Amid Overheating Concerns

Ethereum's Open Interest on the Chicago Mercantile Exchange (CME) surged to a record $7.85 billion, signaling heightened institutional participation. The influx of liquidity into both futures and spot markets underscores growing confidence, yet technical indicators suggest a potential pullback.

Despite gaining 52% over the past month, ETH's recent price action has lagged behind its bullish momentum. Analysts caution that the market may be overheating, with derivatives data pointing to an imminent correction. The CME futures chart reveals critical resistance levels that could trigger a downturn.

Ethereum On-Chain Volume Surges 288% in Three Weeks Amid Market Rally

Ethereum is experiencing heightened volatility following a robust multi-week rally that began in late April. The cryptocurrency recently touched a local high near $3,850 before retracing slightly and consolidating below $3,750. While some investors view this as a potential loss of momentum, others interpret the pause as a healthy consolidation phase preceding another upward leg.

Analyst Ted Pillows highlights a staggering 288% increase in Ethereum's on-chain volume over just three weeks, signaling renewed institutional interest and network activity. USD-denominated volume has reached $10.38 billion—levels not seen since late 2021. This surge coincides with improving regulatory clarity in the US and favorable macroeconomic conditions for risk assets.

The altcoin market appears to be gathering strength, with Ethereum leading the charge. Market observers suggest the current consolidation may present an optimal entry point before potential continuation of the rally. The volume spike mirrors patterns seen during previous altcoin seasons, suggesting capital rotation may be underway.

Robinhood Offers 2% Bonus on Crypto Transfers Amid ETH Unstaking Activity

Robinhood Markets Inc. has introduced a limited-time incentive, matching 2% of cryptocurrency deposits transferred to its platform. The promotion coincides with a surge in Ethereum unstaking activity following the network's Shanghai upgrade.

The brokerage's move signals intensifying competition for digital asset market share among retail-focused platforms. Robinhood's zero-commission structure for crypto trading positions it as a formidable contender against traditional exchanges.

$1,000 in Pepeto Could Turn Into Over $87,000: Why This Meme Coin Is a Must-Watch

PEPETO has emerged as a standout in the meme coin frenzy of early 2025, with its Ethereum-based architecture enabling fast and low-cost transactions. The project's presale performance and growing community engagement suggest potential to outperform established tokens like Shiba Inu, PEPE, and BONK.

Market observers note the token's speculative appeal mirrors earlier crypto success stories, where modest investments yielded exponential returns. Unlike many meme coins, PEPETO's technical foundation on Ethereum provides tangible utility through efficient transaction capabilities.

Arthur Hayes Predicts CryptoPunks Will Outperform Ethereum in Current Cycle

BitMEX co-founder Arthur Hayes has sparked debate with his bold claim that CryptoPunks, the original NFT collection, will eclipse Ethereum's performance this market cycle. The assertion hinges on what Hayes describes as "internet status culture"—a dynamic where ETH holders increasingly flaunt wealth through digital art and status symbols like the scarce 10,000-punk collection.

Market activity supports the theory. A recent 76-Punk sweep totaling $13.5 million marked the largest such purchase since 2021, while the collection's floor price hit 100 ETH. "8 billion people, 10,000 Punks—do the math," remarked investor Parzival, underscoring the asset's scarcity premium. The NFT market overall saw a $1 billion single-day volume surge, signaling renewed frenzy.

Hayes frames the trend as inevitable: "The global economy runs on status, and internet society is no different." As institutional adoption pushes ETH higher, he anticipates capital will cascade into blue-chip NFTs as vehicles for conspicuous consumption.

Ethereum Institutional Demand Surges as BitMine and BlackRock Hit Milestones

Ethereum's institutional adoption reaches new heights as BitMine Immersion Technologies announces holdings exceeding 560,000 ETH, valued at over $2 billion. The crypto treasury firm purchased 266,109 ETH last week alone, advancing toward its ambitious goal of controlling 5% of ETH's total supply. Meanwhile, BlackRock's iShares Ethereum Trust (ETHA) crossed $10 billion in inflows, becoming the third-fastest ETF in history to achieve this milestone.

The ETH price rallied to $3,680 following the news, retesting the key $3,780 resistance level after bouncing off the 20-period EMA on 12-hour charts. BitMine now surpasses SharpLink Gaming as the largest corporate ETH holder with 566,776 ETH, demonstrating growing confidence among institutional investors in Ethereum's long-term value proposition.

BOB Debuts as First Hybrid ZK Rollup, Merging Validity and Optimism on Ethereum

BOB, a hybrid LAYER 2 blockchain, has launched as the first Hybrid ZK Rollup in collaboration with RISC Zero, Conduit, and Boundless. This innovation combines zero-knowledge proofs with optimistic rollups to enhance Ethereum's scalability, security, and efficiency.

The partnership leverages RISC Zero's zkEVM platform, Conduit's rollup-as-a-service infrastructure, and Boundless's zero-knowledge proof ecosystem. BOB's hybrid approach aims to set a new benchmark for decentralized networks by merging cost-efficient optimistic transfers with on-demand ZK validity proofs.

In a public announcement, BOB emphasized this milestone as a transformative step for Ethereum's Layer 2 landscape. The project's unique architecture could redefine how rollups balance speed, security, and decentralization in practice.

Will ETH Price Hit 4000?

Technical and fundamental factors suggest ETH has a 68% probability of testing $4,000 within 2 weeks:

| Factor | Bullish Signal | Bearish Risk |

|---|---|---|

| Price vs 20MA | +12.2% premium | Overextension |

| Bollinger Bands | Upper band at $4,125 | Rejection possible |

| On-Chain Volume | 288% increase | Leverage concerns |

"The $3,780-$4,125 zone is critical - a clean break could trigger algorithmic buying," says BTCC's Ava.

68%

2 weeks